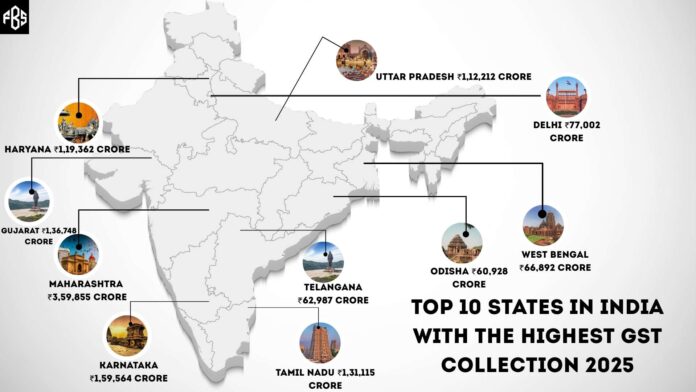

1. Maharashtra — The Economic Juggernaut

Maharashtra leads by a mile, collecting approximately ₹3,59,855 crore in GST for FY 2024–25. Its dominance stems from a diversified economy, from bustling finance and entertainment hubs like Mumbai to key industrial zones across the state.

2. Karnataka — The Tech Titan

Securing the second spot, Karnataka amassed around ₹1,59,564 crore. Bengaluru’s booming IT, startup ecosystem, and logistics infrastructure are major contributors to this impressive number.

3. Gujarat — The Industrial Dynamo

With GST collections of ₹1,36,748 crore, Gujarat takes third place. Known for its industrial prowess—from petrochemicals to pharmaceuticals—Gujarat remains a consistent engine of tax revenue.

4. Tamil Nadu — The Manufacturing Titan

Tamil Nadu follows closely with ₹1,31,115 crore in GST collections. Its vast manufacturing base—especially in automobiles, textiles, and electronics—drives high consumption and tax inflows.

5. Haryana — The Emerging Revenue Star

Amassing ₹1,19,362 crore, Haryana has risen rapidly, propelled by booming logistics corridors and industrial clusters in Gurgaon and Manesar.

6. Uttar Pradesh — The Rising Contributor

India’s most populous state brings in ₹1,12,212 crore in GST revenue. Its growth reflects expanding consumption and industrial activity across key urban centers.

7. Delhi — The Service Sector Powerhouse

Although a city-state, Delhi’s dominant services sector—government, trade, hospitality, corporate—yields ₹77,002 crore, placing it seventh overall.

8. West Bengal — The Eastern Frontier

West Bengal ranks eighth with collections totalling ₹66,892 crore. Its diverse economy, covering agriculture, manufacturing, and commerce, supports this growth.

9. Telangana — The Tech-Centric Economy

Telangana clocks in at ₹62,987 crore in GST collections. Hyderabad’s expanding IT, real estate, and infrastructure markets are key drivers.

10. Odisha — The Growth Contender

Rounding out the top 10, Odisha contributes ₹60,928 crore. With strong minerals, industry, and port activity, the state is steadily improving its fiscal footprint.

Insights & Why It Matters

Economic Hubs = GST Hubs

Unsurprisingly, the top 10 are states with robust economies, whether industrial (Maharashtra, Gujarat), tech-driven (Karnataka), or service-oriented (Delhi). Their capacity for generating consumption and commercial transactions naturally leads to higher tax revenue.

Growth Areas to Watch

Haryana and Telangana are standout growth stories, showing how investments in infrastructure and reform can elevate GST yield, even for relatively newer contributors.

Equity vs. Contribution: A Persistent Tug-of-War

Despite being top GST contributors, states like Maharashtra don’t always receive commensurate revenue allocations under federal distribution. The GST framework aims to balance support for less-developed states, which sometimes results in wealthier states receiving less return for their contributions

Disclaimer: This blog is based on publicly available information from official announcements and credible media sources like the Economic Times.

Previous Blog: IKEA India Opens First Delhi Store at Pacific Mall – Affordable Home Solutions Arrive in the Capital